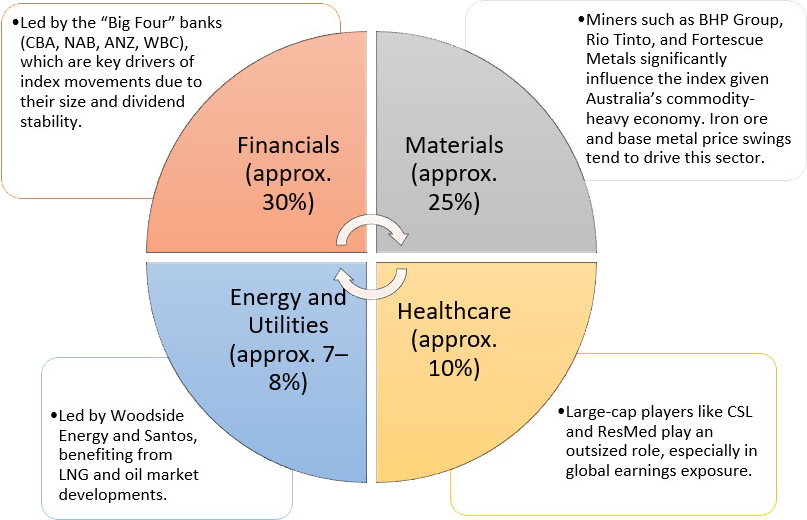

The S&P/ASX 300 Index (XKO) is one of the most comprehensive measures of the Australian equity market, covering the top 300 listed companies by market capitalization. It accounts for over 90% of the ASX’s total value, giving investors exposure to both blue-chip giants and smaller growth companies. The index is structurally weighted toward financials and resources, reflecting Australia’s banking strength and commodity-driven economy, while also including meaningful representation from healthcare, technology, energy, and consumer sectors. As such, it captures both domestic economic conditions and global market trends.

Movements in the ASX 300 are influenced by factors such as Reserve Bank of Australia policy, commodity demand (especially from China), and global monetary and geopolitical developments. Recently, the index has been trading near multi-year highs, supported by strong earnings from major banks, resilient iron ore and energy exports, and defensive contributions from healthcare and technology. While the outlook remains constructive, risks around high interest rates, China’s economic slowdown, and global uncertainty mean the index is likely to experience periods of consolidation alongside its longer-term growth trajectory.